Did you know that millions of African citizens remain financially excluded today? It is an unfortunate reality that they are still lacking access to essential financial services that could significantly improve their lives.

However, the rise of digital financing is changing this narrative, offering not only financial inclusion but also contributing to the broader goals of sustainable development.

At VeryPay, we envision a future where African citizens go from underbanked to financially and economically included by using our innovative payment technology to go cashless, create digital financial records, gain access to credit, and improve their livelihoods. This vision drives our commitment to creating a more sustainable financial ecosystem that benefits all areas of society.

The Power of Fintech in Driving Financial Inclusion

Fintech is rewriting the financial landscape in Africa by improving the way people access financial services and supporting Sustainable Development Goals (SDGs).

By leveraging mobile money to reach unbanked and underbanked populations, FinTech has reduced the barriers to financial inclusion, enabling people to save, invest, and access credit without the need for traditional banking infrastructure. In doing so, FinTech supports the Sustainable Development Goals by reducing poverty, fostering economic growth, promoting innovation, and reducing inequalities across the continent.

Mobile money and digital payments provide a lifeline to those previously excluded from traditional banking systems while driving sustainable economic growth. Despite these advancements, significant challenges remain, including limited access to banking infrastructure, high transaction costs, and geographic barriers.

At VeryPay, our mission goes beyond providing a technology product; we aim to empower individuals and communities by giving them the tools they need to participate in the financial system and contribute to a more sustainable future. This mission is fueled by our passion to catalyze financial inclusion for citizens and drive economic growth across the continent.

Real-World Impact: How VeryPay Aims to Disrupt Key Sectors

To truly understand VeryPay’s impact, it’s essential to examine how our solutions will make a difference in specific sectors, aligning with financial inclusion and sustainability goals. Here are a few key industries we are currently working with.

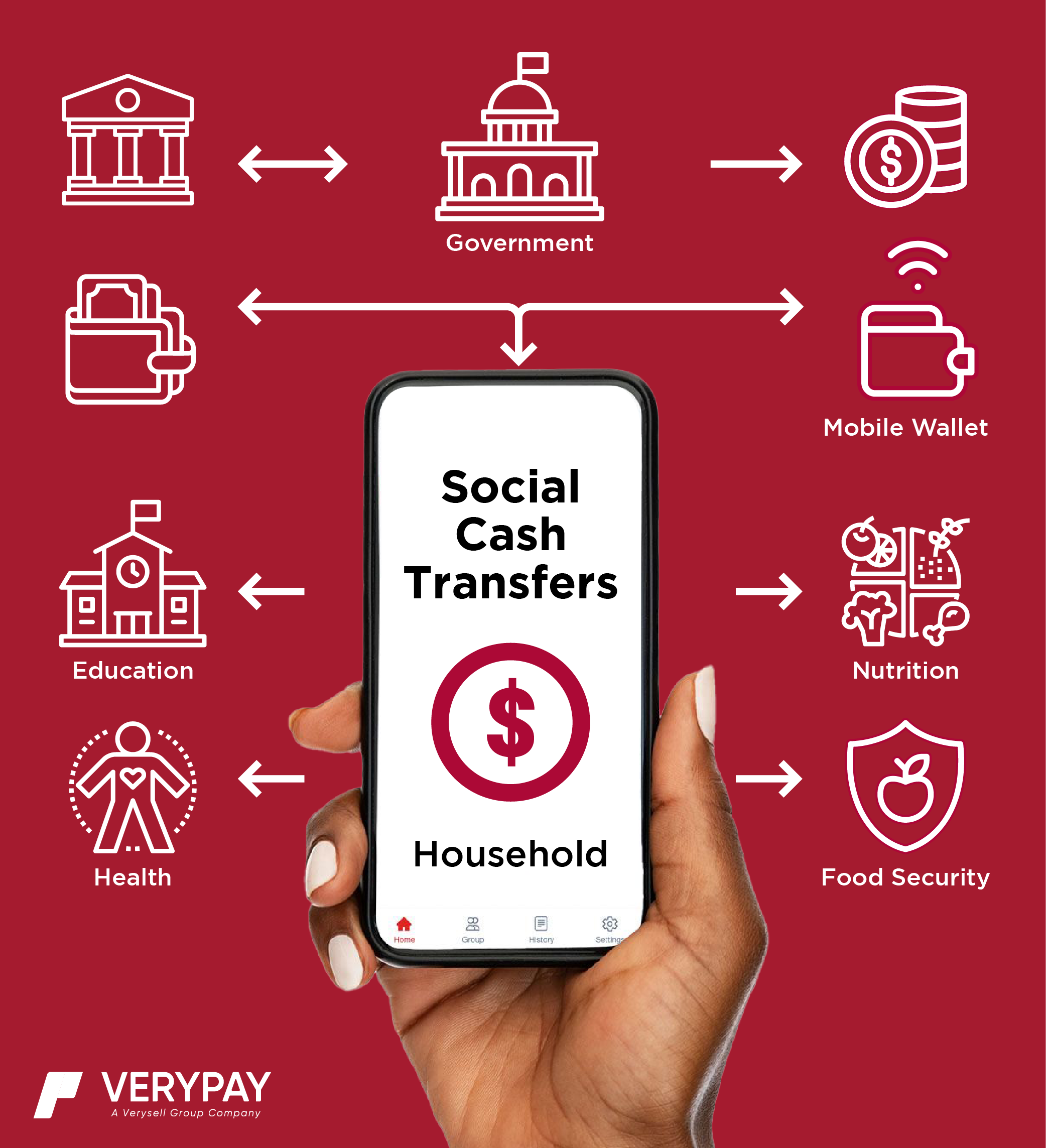

Supporting Social Cash Transfers: Digitising Government Welfare Payments

Social cash transfer programs have become a vital tool in Africa’s strategy for poverty alleviation and social protection. Traditionally administered by governments in cash, these programs provide regular payments to vulnerable households, aiming to improve their economic conditions and overall well-being.

At VeryPay, we see an opportunity to digitise these cash transfers, partnering with governments and mobile wallet providers to deliver funds more securely and efficiently. By transitioning from physical cash to digital payments, we can enhance financial inclusion for the most vulnerable populations, ensure timely and transparent disbursements, and help beneficiaries build digital financial records. This shift not only supports economic stability for these households but also fosters broader financial literacy and inclusion across communities.

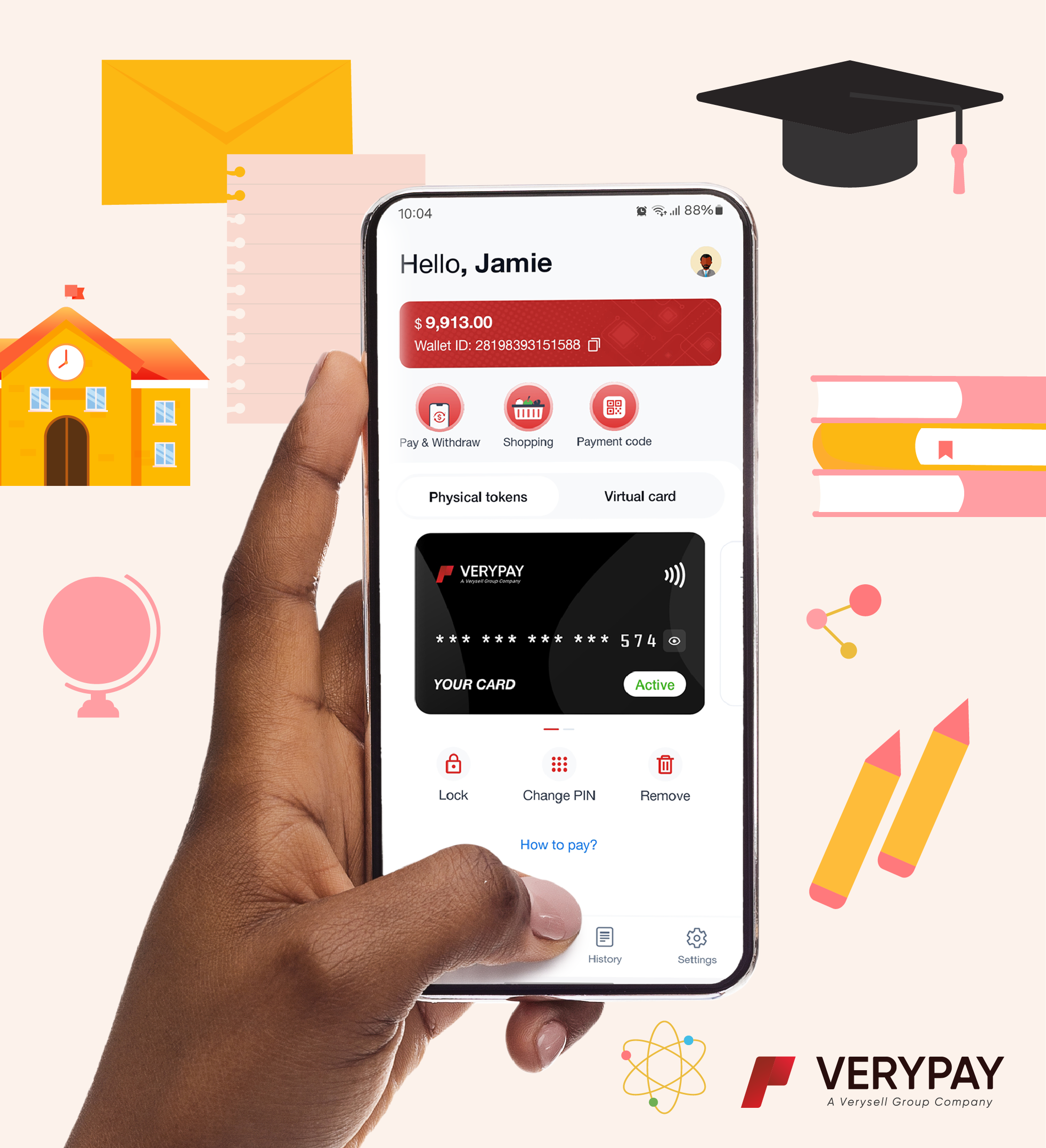

Eliminating Cash Risks in Education: How VeryPay is Simplifying School Payments

In many parts of Africa, paying for school fees and related expenses is still done with cash, which can be risky and inconvenient. VeryPay integrates with existing mobile wallets, allowing parents to make these payments digitally, securely, and conveniently. This not only reduces the risks associated with carrying cash but also supports the SDG of quality education by ensuring that financial barriers do not impede access to schooling.

How VeryPay Simplifies Transportation Payments by Reducing Cash Dependence

Public transportation is a critical service for millions of commuting Africans, but paying for rides often involves handling cash, which can be cumbersome and unsafe. VeryPay’s contactless payment solutions enable commuters to pay for their rides quickly and securely using their mobile devices, improving the overall efficiency and safety of the transportation system. This aligns with the SDG of sustainable cities and communities by promoting safer and more efficient public transport systems.

From Pilot to Full Launch: How VeryPay Rolls Out Its Solutions

VeryPay’s implementation process is designed to be both efficient and effective. Typically, the journey begins with a pilot program, where our solutions are tested and refined to meet the specific needs of the market. This phase usually takes two to three months, depending on the project’s complexity.

Following the pilot, we move into a market rollout, gradually introducing our services to a broader audience. Finally, we transition into a full-scale launch, ensuring that every aspect of our solution is optimized for success. These pilots are crucial not just for fine-tuning our technology but also for ensuring that our solutions support sustainable development in the regions where they are deployed.

Leading the Conversation: VeryPay’s Role at AFSIC 2024

As we continue to lead the charge in financial inclusion and sustainability, we’re excited to share our insights at AFSIC 2024, one of Africa’s premier investment events taking place in London this year. Our participation underscores our commitment to driving innovation in the fintech space and contributing to the SDGs:

Philippe Vogeleer, our Chairman of the Board of Directors, will present a keynote on Fintech innovation and join the panel “Harnessing Digitalisation in Financing the Sustainable Development Goals.” They will explore how digitalization can facilitate SDG financing, emphasizing the importance of transparency, accountability, and data security in sustainable development.

Seun Solanke, our CEO, will join the “FINTECH INNOVATION Panel” to discuss the role of fintech in expanding access to financial services and promoting inclusion, showcasing VeryPay’s contributions to these efforts. They will also touch on how these innovations support the broader goals of sustainable development by creating more resilient and inclusive financial systems.

We invite you to join us at AFSIC 2024, where these discussions will provide valuable insights into the future of digital payments, financial inclusion, and sustainable development in Africa.

Check out our latest feature on Ventures Africa “How VeryPay is helping to digitize Africa’s cash economy through mobile payments”

If you haven’t registered to attend yet, use VIP Registration Code AF2420S for a discounted rate.

Register to attend: https://www.afsic.net/

Together, We Can Build a More Inclusive and Sustainable Future

Judith, VeryPay’s Customer Success Manager, meeting with parents and students in Uganda

Judith, VeryPay’s Customer Success Manager, meeting with parents and students in Uganda

FinTech is pivotal in reshaping the financial landscape across Africa, offering new opportunities for inclusion and sustainability. At VeryPay, we are proud to be part of this movement, driving innovation and making financial services more accessible to those who need them most. As we continue to expand our reach and refine our solutions, we remain committed to our mission of creating a more inclusive and sustainable financial ecosystem for all.

To learn more about how VeryPay can transform financial transactions in various sectors, we encourage you to explore our solutions further or connect with us at AFSIC 2024 on October 7th-9th in London.