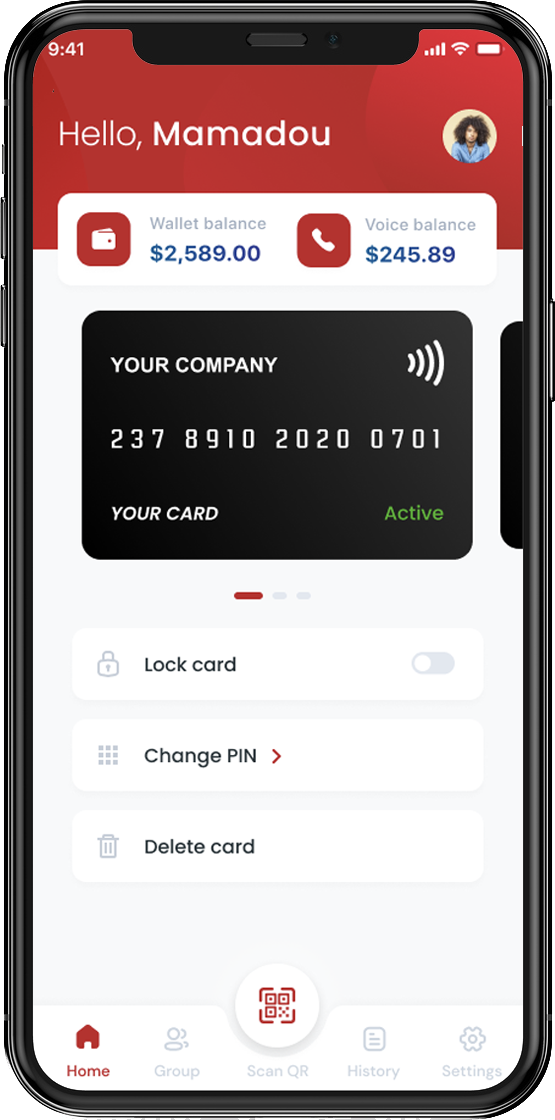

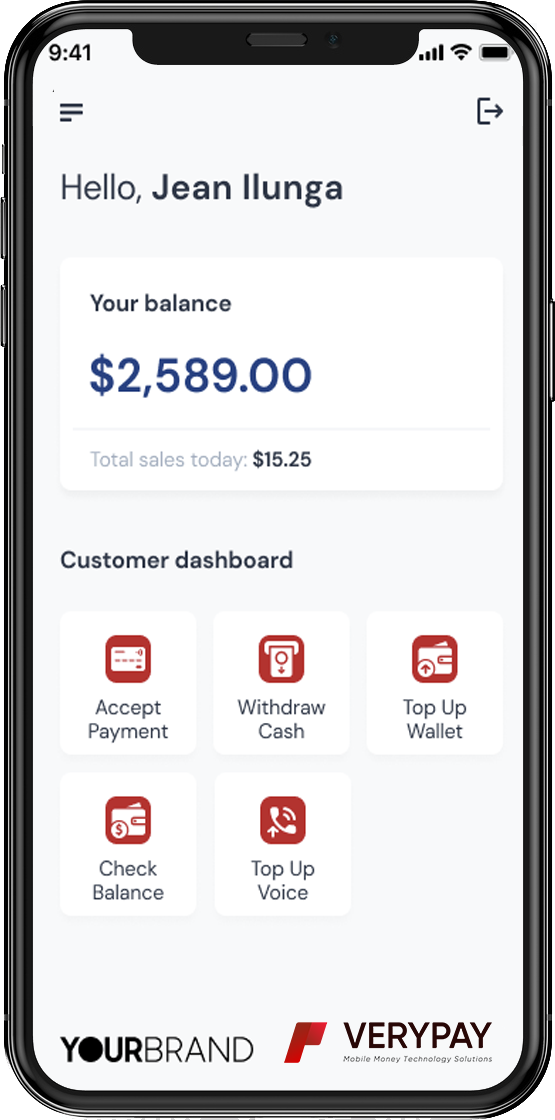

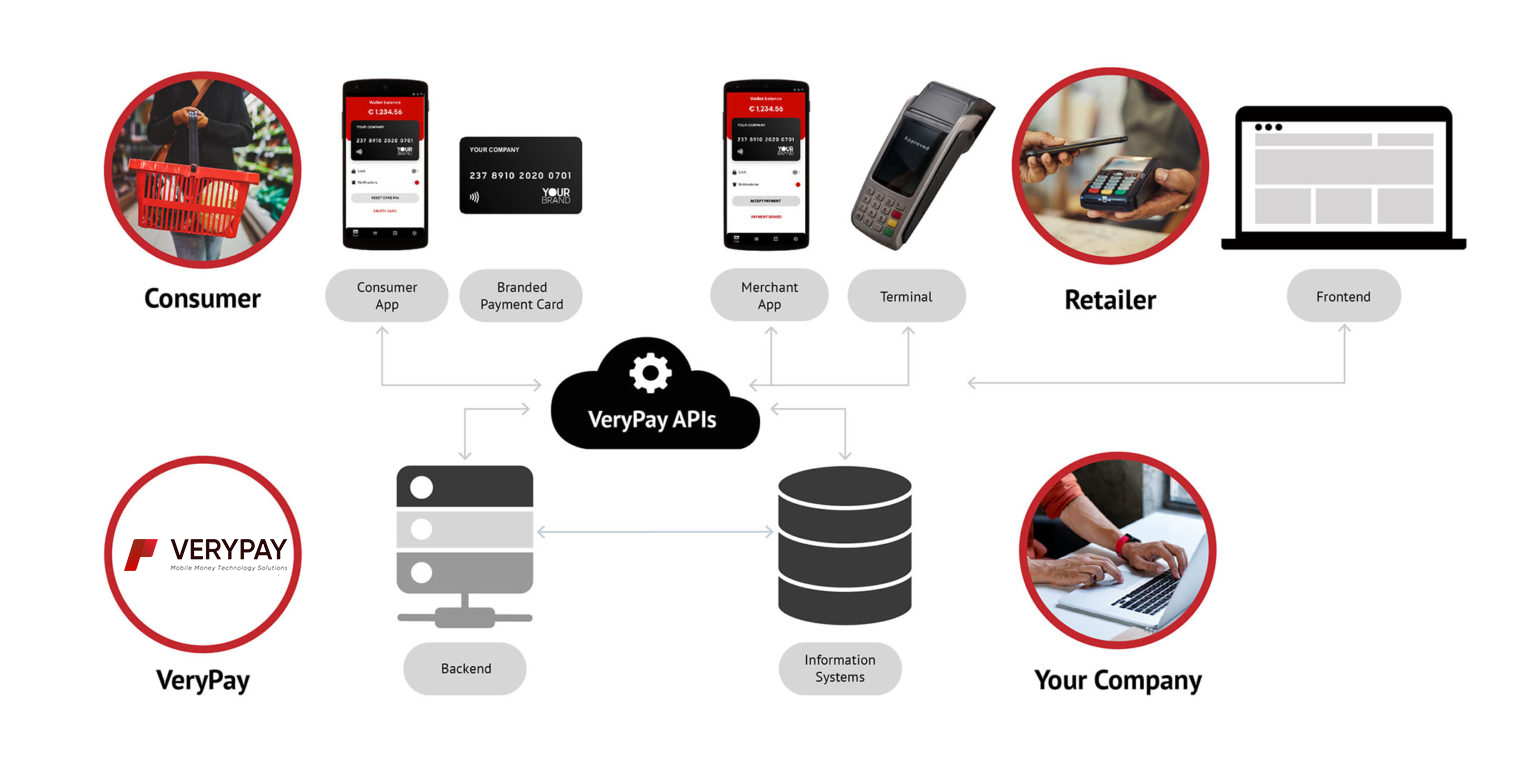

The VeryPay platform offers standalone agent, merchant and consumer apps that are white-labelled and can be integrated into the existing application architecture of any MNO. The platform is wallet agnostic, meaning that irrespective of your core wallet infrastructure, we act as a companion solution to enhance the features and functionality of your mobile money solution. VeryPay is integrated into several market leading eWallets used by mobile network operators across the African continent, such as Ericsson, Comviva and Wallet Factory.

With multiple, pre-built integrations, MNO’s can quickly, easily and cost effectively deploy VeryPay into their core wallet infrastructure. If you have the need to customize any of the platform components, our team of over 200 offshore developers can be there to help design, build and deploy the most effective solution.