Mobile Network Operators’ biggest goal is to ensure a user-friendly mobile money experience for customers and merchants. By implementing the VeryPay closed-loop payment system alongside a traditional open-loop Visa and MasterCard solution, MNOs can offer a wide range of benefits customised to user needs.

Mobile Network Operators’ biggest goal is to ensure a user-friendly mobile money experience for customers and merchants. By implementing the VeryPay closed-loop payment system alongside a traditional open-loop Visa and MasterCard solution, MNOs can offer a wide range of benefits customised to user needs.

Here’s how the synergy between offering a closed and open-loop payment system can provide MNOs with a competitive edge that financially includes a larger percentage of the African population.

Expanding Merchant Payment Capabilities

VeryPay enables any subscriber to sign up as a merchant to accept digital payments from a consumer. With no requirement for a bank account or merchant account, any existing mobile money subscriber can be quickly and easily set up. By simply downloading the merchant app, an NFC android smartphone can be used as a payment acceptance terminal. This means that MNOs can offer digital payment solutions quickly and easily to a wider range of its subscriber base who might be excluded from operating a traditional Visa / Mastercard solution.

VeryPay enables any subscriber to sign up as a merchant to accept digital payments from a consumer. With no requirement for a bank account or merchant account, any existing mobile money subscriber can be quickly and easily set up. By simply downloading the merchant app, an NFC android smartphone can be used as a payment acceptance terminal. This means that MNOs can offer digital payment solutions quickly and easily to a wider range of its subscriber base who might be excluded from operating a traditional Visa / Mastercard solution.

Broadening Consumer Payment Options

VeryPay offers group sharing functionality that allows a single mobile money account to be shared between multiple users. Multiple payment tokens can be linked to a single account and the wallet owner can assign spending limits to each user. This extends an MNO’s digital payment offering to new user groups like children, drives digital financial inclusion and increases mobile money transaction numbers.

VeryPay offers group sharing functionality that allows a single mobile money account to be shared between multiple users. Multiple payment tokens can be linked to a single account and the wallet owner can assign spending limits to each user. This extends an MNO’s digital payment offering to new user groups like children, drives digital financial inclusion and increases mobile money transaction numbers.

Reducing Transaction Fees

VeryPay is a companion solution for any mobile network operator that manages its own wallet infrastructure. The system bypasses the traditional banking infrastructure, meaning there is no involvement of issuers, processors or acquiring banks. Payments are processed within the VeryPay network, meaning that because there are fewer parties requiring a share of the transaction fees, they are typically lower than for open-loop solutions.

Offering Diverse Payment Methods

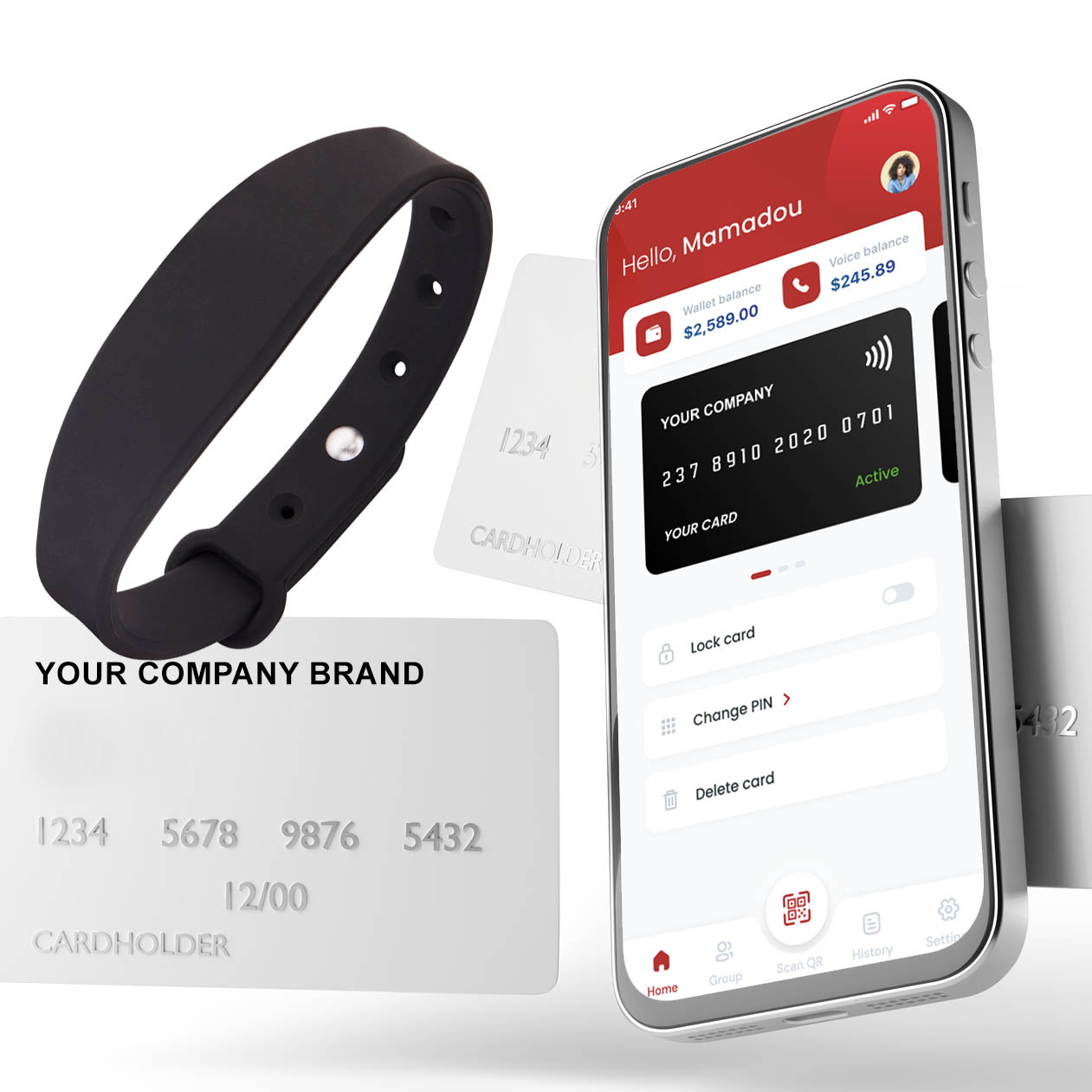

VeryPay offers a wide range of payment options, catering for multiple types of users. Payment tokens are offered in the form of cards, wearable devices (bracelets), QR codes or virtual cards. This caters to all types of users including those without smartphones.

VeryPay offers a wide range of payment options, catering for multiple types of users. Payment tokens are offered in the form of cards, wearable devices (bracelets), QR codes or virtual cards. This caters to all types of users including those without smartphones.

Gaining Direct Control Over Transactions

Closed loop payment systems offer more direct control over transaction processing, meaning that MNO’s can collect and analyze detailed data on customer spending patterns, preferences, and behaviors within their ecosystem. This provides valuable insights for targeted marketing and personalized offerings.

Ensuring Robust Data Security

Unlike open-loop systems where data is shared across multiple parties, the VeryPay system offers full ownership and control over customer transaction data. This allows for more comprehensive and secure data management. The closed nature of the VeryPay system allows for more stringent monitoring of transactions, potentially reducing fraudulent activities and improving overall security.

Learn more about how VeryPay ensures the highest levels of security with its CLP system.

Customizing for Various Sectors

The VeryPay system can be easily adapted for different use cases due to its flexibility and customization options. VeryPay currently offers customized solutions for retail, transportation, and education sectors.

By implementing VeryPay alongside a traditional open-loop payment system, MNO’s can create a more comprehensive and flexible payment ecosystem that caters to various customer preferences and use cases, ultimately enhancing the overall customer experience and potentially boosting mobile money revenues.