Mobile money solutions in Africa are shaking up the world of financial services, providing millions with convenient, accessible, and secure alternatives to traditional banking. These digital payment services are shifting the economic landscape and driving unprecedented levels of financial inclusion across the continent.

“In 2019, 200 million users made 24.46 billion mobile money transactions in Sub-Saharan Africa and the Middle East and Northern Africa, accounting for 64.15 percent of all transactions made worldwide,” according to Statista.

But as we celebrate this rapid growth, we must ask: How can we ensure these systems remain secure as they scale?

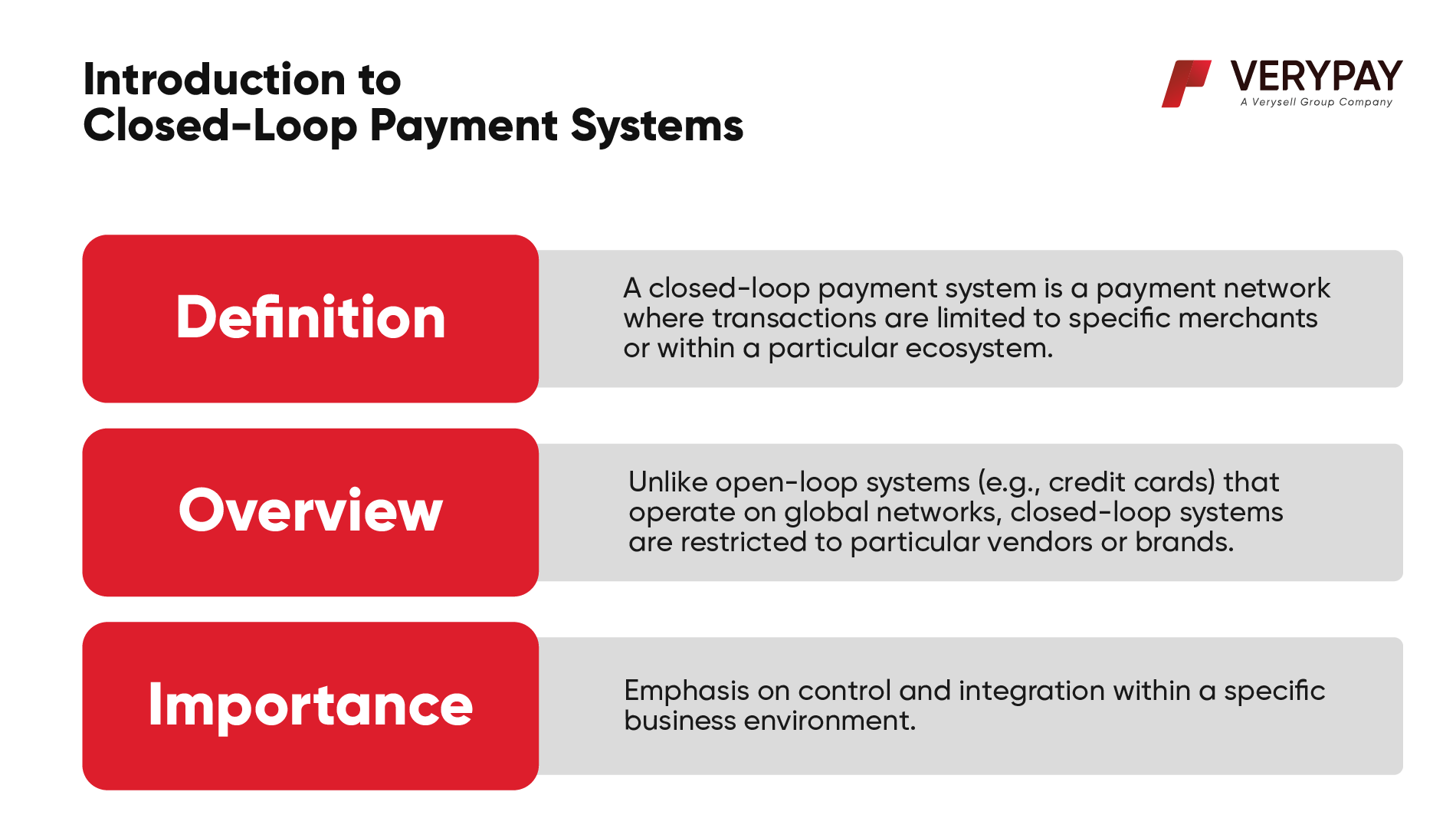

With expansion comes significant security hurdles. The need for robust cybersecurity measures within mobile money technologies and closed-loop payment systems (CLP) is becoming increasingly critical. Addressing these challenges is essential to sustaining the momentum of financial innovation in Africa.

What are the Biggest Obstacles to Safe and Secure Mobile Money Usage?

Fraud and Cybercrime: The Invisible Threats

The very accessibility that makes mobile money appealing also increases its susceptibility to cyber threats. Users are particularly exposed to phishing attacks, identity theft, and unauthorized transactions. Fraudulent schemes often exploit user limited digital literacy and the convenience of quick transactions, which may bypass stringent security checks. The integration of advanced security technologies and user education is crucial to mitigate these risks.

Infrastructure Challenges: Connectivity and Security

In many parts of Africa, mobile money systems must operate over networks with poor internet connectivity, compounded by inadequate server infrastructure. This can lead to transaction failures or interruptions which open windows for security vulnerabilities, allowing cybercriminals to exploit incomplete transactions or data inconsistencies.

IT Security: The Backbone of Mobile Money Solutions

The efficacy of mobile money solutions heavily depends on the underlying IT security infrastructure. However, maintaining state-of-the-art IT security measures is a significant barrier, particularly due to the shortage of a skilled IT workforce and expert system integrators in the region. This gap leaves mobile money systems prone to sophisticated cyber-attacks, including hacking and malware infiltration, which could compromise vast amounts of sensitive financial data.

Given these concerns, the argument for bolstering security in mobile money and CLP systems becomes compelling. Enhanced security protocols, continuous IT security training, and robust infrastructure investment are essential. Strengthening these areas will not only protect individual users but also sustain the integrity of the broader financial ecosystem, which is crucial for economic stability and growth in Africa.

How a Closed-Loop Payment System Can Bridge the Divide

A Closed-Loop Payment (CLP) system such as VeryPay is a FinTech solution where transactions can only occur within its infrastructure. In this closed environment, payments and monetary exchanges are confined to predefined users and participating businesses.

Think of the VeryPay CLP solution as a Starbucks card or a retail store gift card; the card can only be used at the issuing store or within its franchise network.

In the context of Mobile Money solutions in Africa, integrating the VeryPay CLP can offer these five distinct benefits:

Enhanced Security

Because the transactions are restricted within a controlled environment, it’s easier to monitor and secure the flow of money, reducing exposure to external fraud and security breaches, thus preventing or significantly reducing cybercrime and fraudulent activities.

Lower Transaction Costs

VeryPay solution enables lower transaction fees since transactions bypass traditional banking channels and third-party payment processors. This cost efficiency can be passed on to users, making transactions more attractive and boosting financial inclusion in the region.

Increased User Engagement and Reduced Churn

A mobile money provider can enhance user retention and loyalty by creating a specific ecosystem where users can spend their money (e.g., within a network of partnered stores and services).

Data Collection and Management

VeryPay CLP allows MNOs to collect detailed data on user spending habits within the network. This data can be used to tailor services, improve customer satisfaction, and devise targeted marketing strategies.

Operational Control

Providers have complete control over the payment system’s features and functionalities, allowing them to customize aspects like transaction limits, rewards, and incentives to meet specific user needs and compliance requirements.

In our on-going work with Mobile Network Operators across the African continent, the top priorities we found are on expanding financial inclusion and simplifying transactions in a cost-effective and secure manner. We built VeryPay as a tailored, secure, and efficient financial ecosystem that caters specifically to evolving regional needs and user behaviors. – Andrey Tikhonov, CTO of VeryPay

In our on-going work with Mobile Network Operators across the African continent, the top priorities we found are on expanding financial inclusion and simplifying transactions in a cost-effective and secure manner. We built VeryPay as a tailored, secure, and efficient financial ecosystem that caters specifically to evolving regional needs and user behaviors. – Andrey Tikhonov, CTO of VeryPay

How VeryPay’s Closed Loop Payment System Ensures Security

VeryPay’s Closed-Loop Payment (CLP) system incorporates an array of advanced security measures designed to safeguard mobile money operations. These measures begin with adhering to the stringent Payment Card Industry Data Security Standard (PCI DSS) and employing secure coding best practices to minimize vulnerabilities.

The system utilizes high-security MiFARE DESFire EV3 chips in its cards and wearables. It is renowned for it’s robust encryption and authentication capabilities, ensuring that every transaction is protected from fraud and unauthorized access.

Secure Coding and PCI DSS Compliance

VeryPay follows industry-leading secure coding practices (1 2 3), which help prevent common security threats such as SQL injection, cross-site scripting, and platform-specific threats. By complying with PCI DSS, VeryPay adheres to high standards for data security—this includes maintaining a secure network, implementing strong access control measures, and regularly monitoring and testing networks.

MiFARE DESFire EV3 Chips

These chips are designed with superior hardware and software security in their core. They support advanced encryption standards and are capable of mutual authentication, which ensures that only authorized devices can interact with the card, thereby securing transaction data at the point of sale and during transit.

AI-Driven Fraud Detection

VeryPay integrates artificial intelligence to detect and prevent fraud proactively. This system analyzes patterns and flags unusual transactions in real time, allowing for immediate action to prevent financial loss, such as locking the card and escalating the issue for adequate resolution.

Regular Security Monitoring

Continuous monitoring of the system’s security posture ensures that potential vulnerabilities are identified and mitigated promptly. This ongoing vigilance helps maintain the integrity and trustworthiness of the mobile money environment.

Looking Ahead: The Future of Mobile Money in Africa

As we look to the future, the role of closed-loop payment systems like VeryPay will become increasingly important. The expansion into new sectors and increased merchant adoption will continue to drive financial inclusion. Integrating technologies such as blockchain, IoT, and AI will further enhance security and functionality, while the rise of contactless and mobile wallet solutions will make transactions even more seamless and efficient.

Building a Secure Financial Future in Africa with VeryPay

These comprehensive security measures make VeryPay an essential solution for mobile money operators in Africa, looking to enhance financial inclusion while ensuring the safety and reliability of their services. VeryPay’s focus on advanced security, combined with operational control and cost-efficiency, distinctively positions it in the market. It sets VeryPay apart from competitors by offering a highly adaptable, customer-tailored, secure, and efficient financial ecosystem that aligns with regional needs and aims to enhance user behaviors.

We invite mobile network operators to discover how VeryPay can transform their payment processes with a secure closed-loop payment system. Contact us for more information or book a call with our team.